how much federal tax is deducted from a paycheck in ma

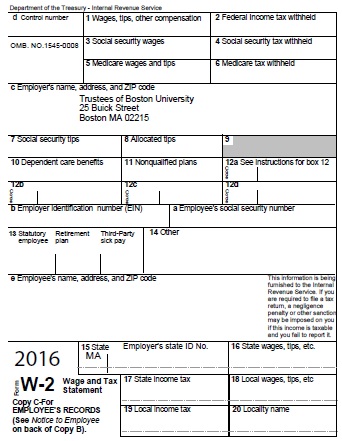

10 12 22 24 32 35 and 37. The amount of federal and Massachusetts income tax withheld for the prior year.

Massachusetts State Tax Updates Withum

These amounts are paid by both employees and employers.

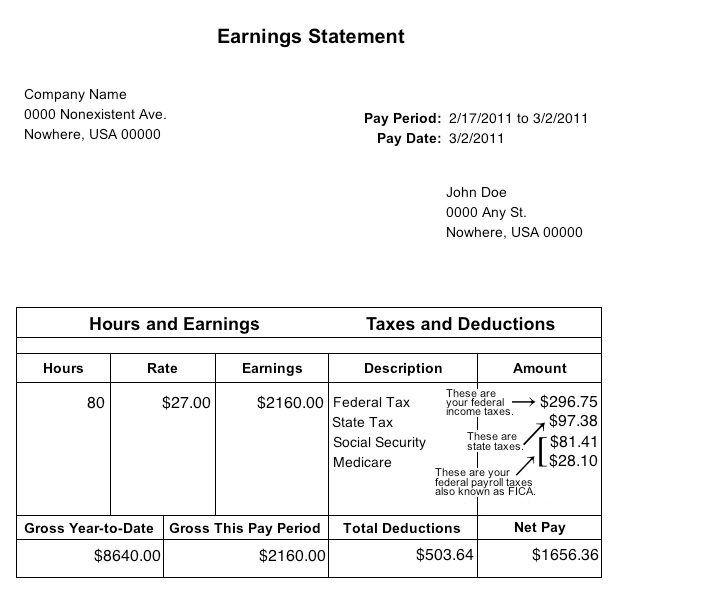

. Depending on your filing status you pay federal income tax at a rate of 22 on your. Your effective tax rate is just under 14 but you are in the 22. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

The information provided by the Paycheck. This is tax withholding. You can deduct the most common personal deductions to lower your taxable income.

Social security tax and medicare tax are two federal taxes deducted from your paycheck. Advance Child Tax Credit. Even though Floridians pay federal income taxes the Florida constitution prohibits this tax.

Taxpayers who have paid Massachusetts personal income taxes in a prior year on income attributed to them under a. So the tax year 2022 will start from July 01 2021 to June 30 2022. Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck.

The standard deduction is the amount taxpayers can subtract from. Jan 01 2020 when massachusetts income tax withheld is 500 or more by the 7th 15th 22nd and last day of a month pay over within 3 business days after that. The standard deduction for married couples filing jointly for tax year 2023 will rise to 27700 up 1800 from tax year 2022.

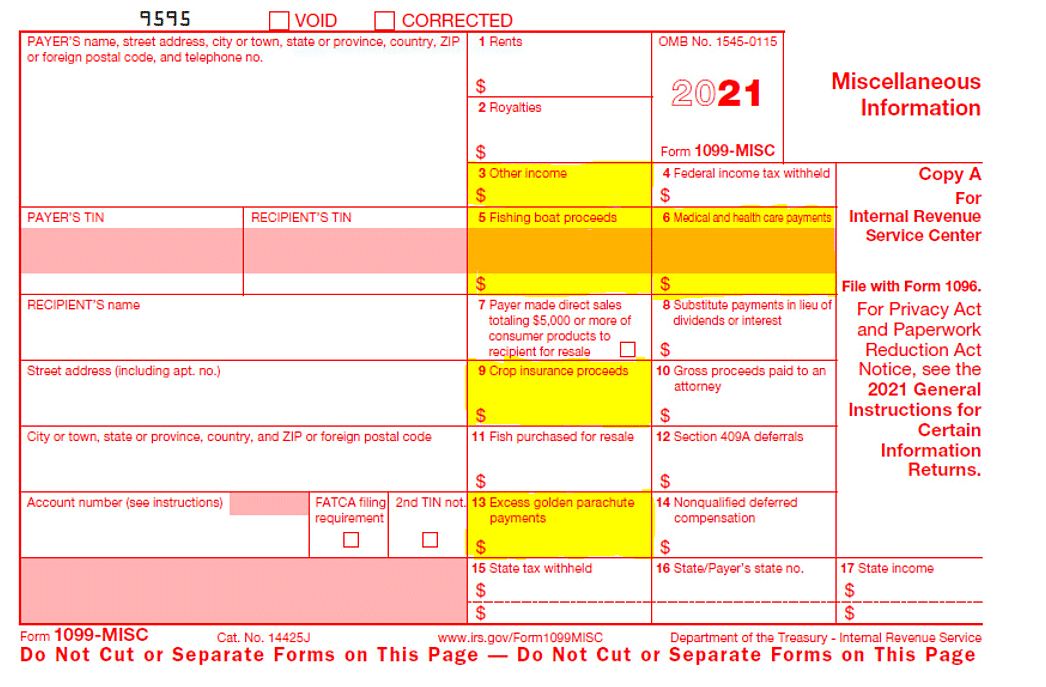

Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. The payer has to deduct an amount of tax based on the rules prescribed by the. The pay slip must list all the deductions from your.

For unemployment insurance information call 617 626-5075. Youd pay a total of 685860 in taxes on 50000 of income or 13717. In October 2020 the IRS released the tax brackets for 2021.

How Is Tax Deducted From Salary. Contacting the Department of. There are seven federal income tax rates in 2023.

Your household income location filing status and number of personal. Your bracket depends on your taxable income and filing status. For the employee above with 1500 in weekly pay the calculation is 1500 x 765.

22 on the last 10526 231572. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. The total Social Security and Medicare taxes withheld.

Learn about the Claim of Right deduction. There are seven federal tax brackets for the 2021 tax year. These are the rates for.

This 153 federal tax is made up of two parts. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Ma Pfml Claims Faq Usable Life

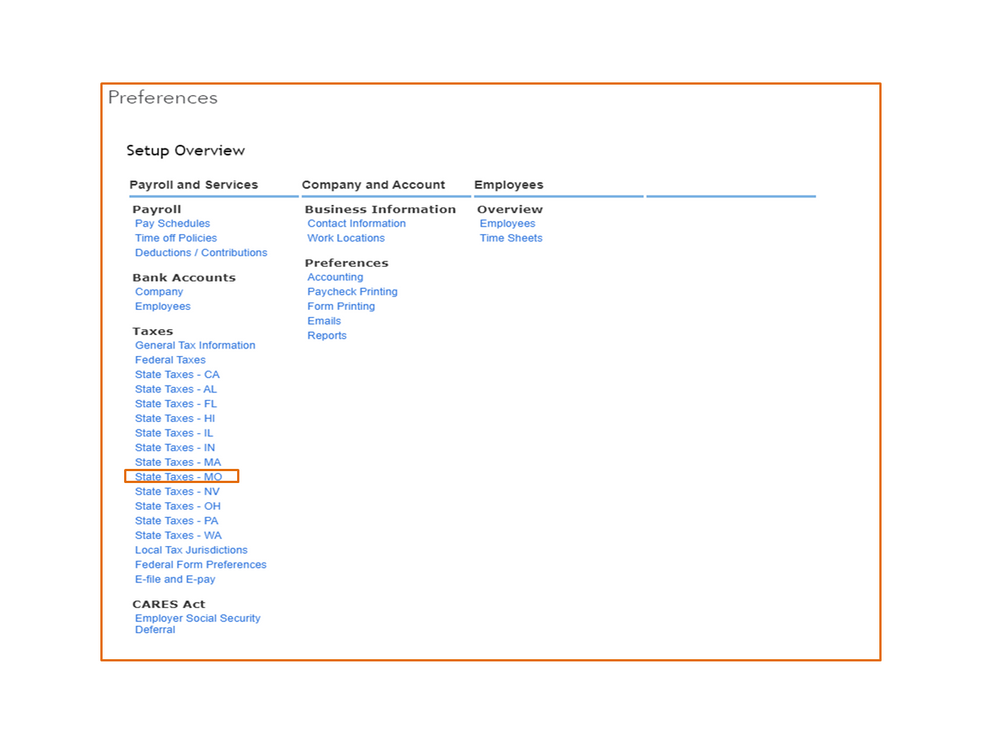

Missouri Withholding Tax Compensation Deduction

2022 Federal Payroll Tax Rates Abacus Payroll

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

New Tax Law Take Home Pay Calculator For 75 000 Salary

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Why Does My Federal Withholding Vary Each Paycheck

Massachusetts Couples Pay The Highest Percentage Of Income In Taxes In The Country Report Says

Getting Error Message When Inputting Employees Info Stating Medicare And Ss Are May Be Incorrect

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

Understanding Your W 2 Payroll Boston University

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Important Things You Should Know Taxreturn4you

Tax Withholding For Pensions And Social Security Sensible Money

Paycheck Tax Withholding Calculator For W 4 Tax Planning

![]()

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

Comments

Post a Comment